July 16, 2025: The Water Cost of Electricity on the Susquehanna River

May 15, 2025: Data Centers and Nuclear Power on the Susquehanna River: More Questions than Answers

Sep 29, 2024: The case against restarting Three Mile Island’s Unit-1

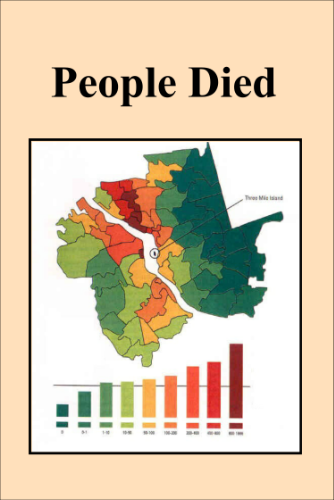

Radioactive: The Women of Three Mile Island

Did you catch "The Meltdown: Three Mile Island" on Netflix?

TMI remains a danger and TMIA is working hard to ensure the safety of our communities and the surrounding areas.

Learn more on this site and support our efforts. Join TMIA. To contact the TMIA office, call 717-233-7897.