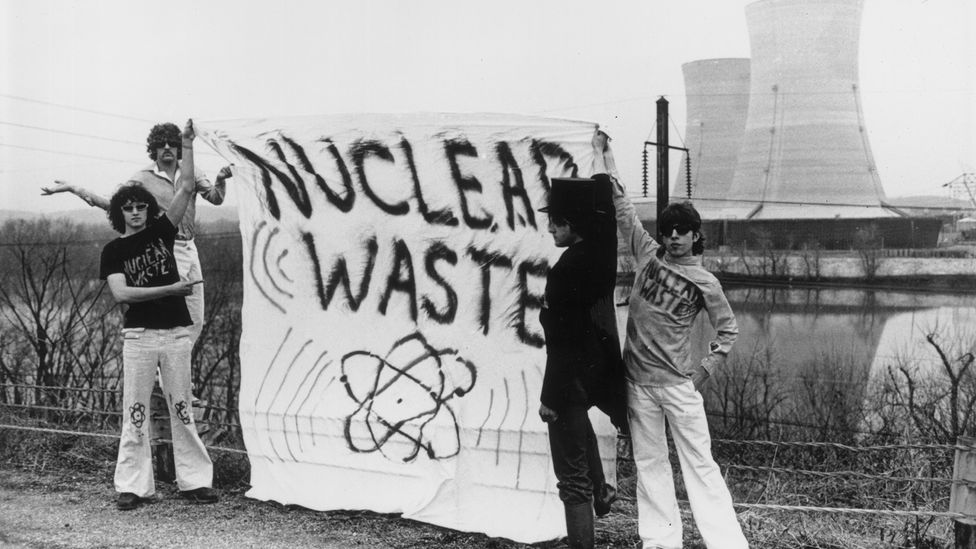

For many Americans, dropping "Three Mile Island" into conversation is like mentioning "Fukushima" or "Chernobyl" – places that have become synonymous with nuclear disaster, no explanation needed.

The actual history is more complicated.

In March 1979, one of two reactors at the Three Mile Island plant in central Pennsylvania partially melted down, in what is to this day the most serious nuclear accident in US history.

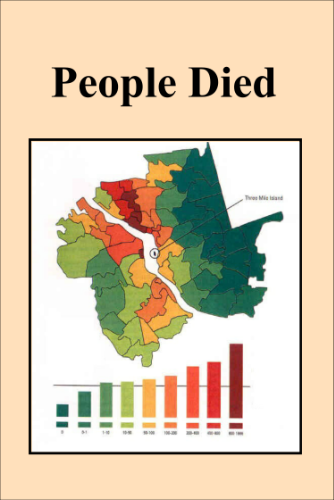

But it resulted in just a small fraction of the damage caused by those disasters in Japan and the Soviet Union. There were no fatalities and few if any long-term health effects (scientific studies have drawn slightly different conclusions on that point).

The whole thing would likely have been a much smaller news story had it not been for a film released only a few days before.

The China Syndrome was a thriller starring Jane Fonda as an intrepid reporter investigating safety problems at a nuclear plant. It was a work of fiction, not a documentary, but the parallels with Three Mile Island damaged the reputation of US nuclear power for years.

The plant was recently in the news again – not for an accident or a hit movie, but by a deal signed by tech giant Microsoft to buy energy from Three Mile Island’s remaining functioning reactor.

And it's just part of a larger trend. Silicon Valley is on the hunt for new sources of power to drive enormous data centres and in particular, the high-power chips that have become the backbone of the artificial intelligence (AI) industry.

Nuclear could help meet that challenge in two respects – it's a potential source of "always on" energy, and unlike fossil fuels, it's carbon-free.

Big tech is making a big bet on nuclear – Microsoft has even recently joined the industry's lobbying group, the World Nuclear Association.

China has one operational small reactor. Others including Linglong are planned or under construction (Credit: Luo Yunfei/ China News Service/ VCG via Getty Images)

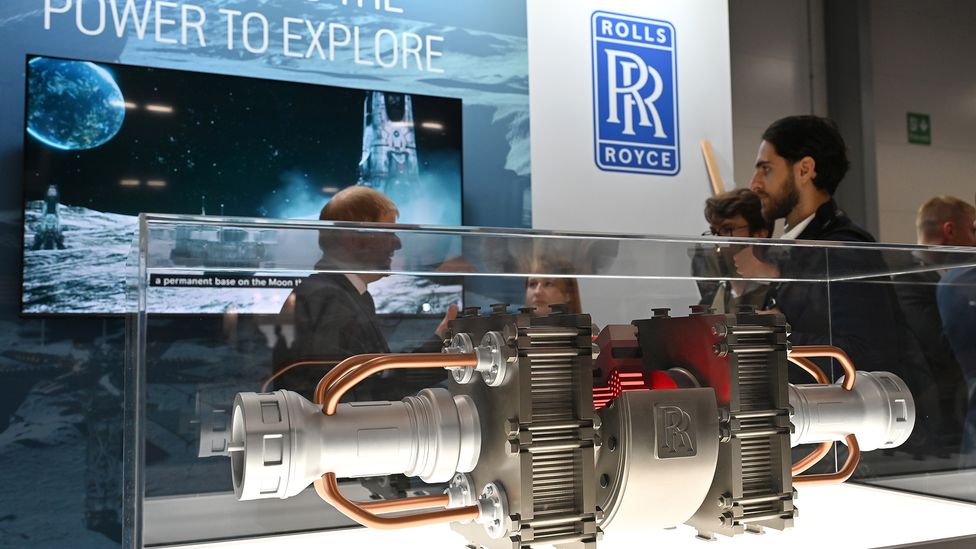

The maker of the Xbox is not alone. Google, Amazon and others are also funding nuclear projects, albeit taking a different tack with a newer technology known as small modular reactors (SMRs).

SMRs run at cooler temperatures, theoretically reducing the risk of a meltdown, and their smaller size also means lower construction costs.

Two such small reactors already provide a relatively small amount of power to electricity grids, one each in China and Russia's far east. So in some respects, SMRs sound like the perfect solution to the growing energy AI demand – if only it were that simple.

"Most SMRs are on paper" and haven't progressed beyond the testing stage, says Allison Macfarlane, the former chair of the US Nuclear Regulatory Commission and now a professor at the University of British Columbia in Canada.

Commercialising the technology will be difficult, Macfarlane says, because a smaller reactor core also means a less efficient reactor – producing less energy from the same amount of fuel. She estimates SMRs are years away from being financially viable.

"You just can’t get around economies of scale," she says. "These are fun ideas. But the tech bros don’t seem to be grounded in reality."

Undaunted, energy companies and tech giants are ploughing resources into research and pilots.

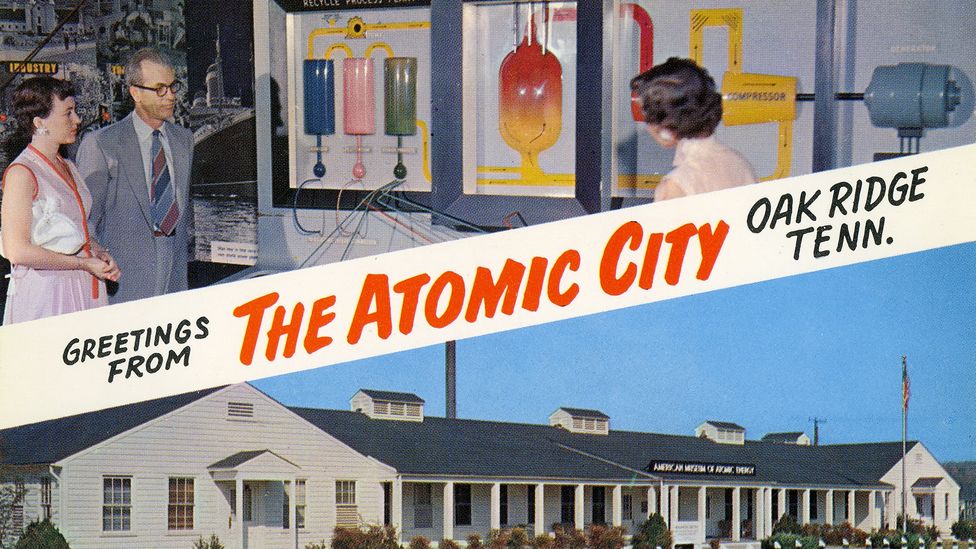

A tourist postcard celebrates the long history of the nuclear industry in Oak Ridge, Tennessee (Credit: Jim Heimann Collection/ Getty Images)

Kairos Power, Google's partner, is hoping to generate 50 megawatts of nuclear power by 2030 – equivalent to the amount of energy needed to power a small town.

The company has set up shop in Oak Ridge, Tennessee – another noteworthy American nuclear site, one that provided crucial support to the Manhattan Project which produced the first atomic bomb.

Kairos calls Oak Ridge a "proving ground" and in a statement to the BBC said that advanced construction techniques will increase efficiency and lower costs.

But even though the company aims to boost energy generation tenfold by 2035, practically it still won't help meet the supercharged energy demands of AI – which is ramping up right now.

"Small modular reactors can provide 24/7 clean energy near data centres," says Haider Raza, an expert in AI and energy use at the University of Essex. "But they won’t come close to solving the coming demand issue in the next year or two."

A report released in April by the International Energy Agency noted that the power demand from data centres, which currently account for around 1.5% of the world's electricity consumption, could double in the next five years. Beyond that, there's huge uncertainty – both in the amount of future demand and what sources might rise to meet it.

Nuclear reactors, Raza and other experts say, may have a role in meeting the AI energy crunch, but only years into the future – and only if the industry can convince an often-sceptical public.

The Three Mile Island meltdown affected the reputation of nuclear energy in the US for decades (Credit: Keystone/ Hulton Archive/ Getty Images)

In March, the small suburb of North Tonawanda, halfway between Niagara Falls and the rust-belt city of Buffalo in Western New York state, took what to outsiders looked like a fairly drastic step – banning nuclear power generation within its borders.

The law was a direct reaction to anger over a proposal floated by a local tech company to build a small reactor for cryptocurrency mining. Deb Gondek, a local activist who prior to retirement had worked as director of sustainability for a food company based in the area, said that many residents were wary of the proposal because they'd already been upset by the noise of the crypto mining operation.

"The initial reaction was 'Oh brother, what are they cooking up now?'," she says. The council vote was unanimous in favour of a ban.

And then there's the issue of what to do with radioactive waste. Researchers at Stanford found that SMRs actually produce more such waste than larger conventional reactors, because more subatomic particles escape from a smaller nuclear core, contaminating surrounding materials.

However, in some places, the possible benefits balance out the risks. Kairos, the company that has partnered with Google, touts its local support in Tennessee, and a recent study by the nonpartisan Pew Research Center found that a slight majority of Americans are in favour of more nuclear energy.

At the same time, there are researchers working on other ways out of the upward demand spiral – ones that don't require a hunt for huge new sources of energy.

Small generators such as this one are receiving a lot of attention even though most have not yet reached the commercial stage (Credit: John Keeble/ Getty Images)

Mosharaf Chowdhury, an associate professor at the University of Michigan notes that AI is growing much faster than previous energy-intensive technologies. Automobiles and computers, for instance, took decades to achieve mass adoption.

"AI has got to saturation point in not even 15 months," he says. "It just grew so fast, we didn't have a second to imagine how to account for it."

Chowdhury and his colleagues are looking at the ways that chips can be configured to suck up less power, or use AI models that rely on smaller or more focused databases of information.

Unfortunately, Chowdhury says, so far "there is no good solution where we have managed to find models that are significantly smaller and run significantly faster but accuracy-wise are just as good."

Still, he insists: "Whatever else is going on, what we should continue to do is more research on how to make energy-optimal AI."

And many businesses are taking a hard look at how they use AI applications and whether they can actually afford them.

"There's no way around the economics," says Haider Raza from the University of Essex, who consults with businesses about their AI use. "When the demand is high, and the supply is low, the only option is to increase the price (of energy), and somebody has to pay for it."

Raza says some of his customers have decided to hold off on AI for the time being – and notes that nuclear will be only one of many sources powering the future of technology.

And for all their big bets on splitting the atom, the tech giants agree. In a recent policy brief, Microsoft noted: "There is no one technology or solution that will meet the vast electricity and decarbonization needs of the markets, societies, and communities across the globe."