Gavin Newsom saved California’s last nuclear plant.

But do we really need it?

Diablo Canyon, California’s last remaining nuclear power plant, was supposed to close by 2025, until Gavin Newsom abruptly changed course.

By John Emshwiller Dec 15, 2025 SFChronicle

Diablo Canyon, California’s last nuclear power plant, was supposed to be closed by now.

In 2016, owner Pacific Gas & Electric reached an agreement with environmentalists and others to shutter the plant by August 2025, turning off the 40-year-old facility’s two domed reactors, marvels of 20th century technology that can power hundreds of thousands of homes. Top state officials, including then Lt. Gov. Gavin Newsom, supported the deal, deeming Diablo Canyon unnecessary and uneconomical as state energy policy increasingly focused on renewables such as solar and wind power.

But suddenly in 2022, Newsom changed course. Now governor, he put his weight behind Senate Bill 846, a law that extended Diablo Canyon’s operating life until 2030. To help keep the plant running, he supplied nearly $1.4 billion in state funds, which officials hoped would be paid back by Biden-era federal subsidies. And for the first time, public utility rate-payers around the state would join those in PG&E’s territory in paying hundreds of millions of dollars a year to run Diablo Canyon.

What caused this giant U-turn?

Newsom said a changed electricity supply-and-demand picture meant Diablo Canyon was needed to avoid blackouts. “In 2022, the Governor recognized the urgent need to extend operations of the Diablo Canyon Power Plant to maintain safe, reliable and affordable electricity,” Newsom’s office said in a statement to the Chronicle.

A Chronicle investigation, though, found that a well-organized, well-financed campaign had pushed to extend the nuclear plant’s life. It involved top marketing, lobbying and research firms, some with extensive ties in Sacramento politics. The effort included an unlikely coalition of tech officials, academics, a former PG&E executive and a Brazilian fashion model turned online nuclear influencer.

Meanwhile, the need for Diablo Canyon wasn’t as clear-cut as the governor portrayed. Some state energy forecasts, both before and after passage of SB 846, projected adequate supplies without the nuclear plant. Data from a report this August showed a large electricity surplus even without Diablo Canyon. And a federal subsidy is projected to pay back only part of the $1.4 billion advance to PG&E — leaving the state with a possible shortfall of almost $600 million.

State officials say the nuclear plant is still needed to ensure power during extreme heat events that are outside official planning standards. But critics say Newsom, who is widely expected to seek the Democratic presidential nomination in 2028, made a political calculation in foisting an unneeded and costly plant onto the public as insurance against fury-inducing and expensive power outages — even limited ones — in the years ahead.

“The rewards were huge and the cost to him was low,” said Matthew Freedman, a staff attorney for The Utility Reform Network, a non-profit consumer-advocacy group actively involved in state ratemaking proceedings. “The cost is paid by ratepayers.”

The main beneficiary, critics argue, was PG&E, which was a major contributor to Newsom’s 2018 gubernatorial campaign. Through SB 846, PG&E gets a $100 million-plus annual fee for managing Diablo Canyon. It also stands to receive over $250 million a year in other fees that could be used for the plant or activities ranging from electrical grid improvements to public communications efforts. And ratepayers also had to fund a new $300 million account to buy replacement power if Diablo Canyon went down because PG&E failed to adequately manage the plant. (Previously, PG&E would have faced paying for such costs.)

Any inference that politics or PG&E’s campaign support influenced the governor is “sloppy and inaccurate reporting,” said a statement from Newsom’s office. “Diablo Canyon remained online because of only one reason: the real, documented threats to our state’s grid reliability.”

In reply to questions, PG&E said it simply responded in 2022 to a state request to extend Diablo Canyon operations.

The plant’s reprieve was something more: an early sign of a broader revival of interest in nuclear power, even in left-leaning states. In June, New York Gov. Kathy Hochul directed state power officials to begin work on a new nuclear plant, the first in a generation. Tech giants such as Google, Meta and Microsoft have made deals for power from nuclear plants to meet the growing electricity needs for artificial intelligence work. By 2040, California’s peak power demand is forecast to increase by about 30% compared with current record peak demand, due in part to AI computing needs.

Now, nuclear plants like Diablo Canyon, recently written off by many as relics, are once again being pitched as the future. Already, PG&E is raising the prospect of keeping Diablo Canyon running past 2030 and is taking steps that, with the state’s permission, could allow it to operate until 2045.

‘An iconic plant’

Diablo Canyon is situated roughly between Los Angeles and San Francisco on a dramatic coastal perch with ready access to ocean water to cool its reactors and related systems. When construction began in the 1960s, government planners envisioned hundreds of nuclear plants supplying the country with cheap and abundant electricity. But soaring construction costs as well as high-profile accidents such as Three Mile Island, Chernobyl and Fukushima dimmed the atom’s prospects.

As did the rise of a dedicated anti-nuclear movement with Diablo Canyon an early target. Protests attracted tens of thousands of demonstrators and resulted in hundreds of arrests. One big concern was earthquake faults, which were only discovered near the plant after construction started. Critics say quakes there could cause dangerous radiation leaks. But PG&E says it has taken adequate safety measures to handle natural disasters, such as earthquakes and tsunamis and federal regulators have agreed.

Left: Diablo Canyon Nuclear Power Plant protesters use ladders to climb over fences in 1978.(Terry Schmitt, The Chronicle) Right: Diablo Canyon Nuclear Power Plant protesters in 1981.(Gary Fong, The Chronicle)

Diablo Canyon Nuclear Power Plant protests organized by Abalone Alliance, a group that formed to oppose the project, in 1981. The plant has long been a symbol of resistance to nuclear power.

By 2016, Diablo Canyon, then responsible for roughly 6% of the electricity generated in California, capable of producing over 2,200 megawatts of power, was the state’s last nuclear plant. And its future was uncertain.

A state commission including then-Lt. Gov. Newsom was considering whether to renew crucial land leases for the plant. State officials were concerned about the plant’s effect, absent expensive cooling-system modifications, on local marine life from using the ocean water. Without the land leases, the plant faced closure by 2018.

So PG&E started talking with environmental groups and others. And in June 2016, the parties announced a deal.

PG&E agreed to close the reactors when their original federal operating licenses expired, in 2024 for unit 1 and 2025 for unit 2. In return, the environmental groups agreed to support extending the state land leases without the cooling-system modifications. There would be enough time in the years before closing to bring on renewable resources to make up for the loss of Diablo Canyon, deal advocates said.

“California’s energy landscape is changing dramatically with energy efficiency, renewables and (battery) storage being central to the state’s energy policy,” said then-PG&E Chief Executive Officer Tony Earley. “As we make this transition, Diablo Canyon’s full output will no longer be required.”

All in all, “PG&E’s analysis projects that it would be more expensive from a customer perspective to continue to operate” the nuclear plant, the company said in a filing with the California Public Utilities Commission.

Newsom and other state officials endorsed the closure deal. In a sense, the nuclear opponents had finally won.

Newsom’s Reversal on Diablo Canyon Power Plant

Gov. Gavin Newsom reversed his earlier stance on shutting down Diablo Canyon and pushed to keep California’s last nuclear plant running until 2030, relying on shifting calculations that could leave Californians footing the bill.

“Diablo Canyon is an iconic plant. The first great anti-nuclear demonstrations occurred there,” said Ralph Cavanagh, who took part in the negotiations for the Natural Resources Defense Council, a longtime critic of the nuclear industry. “If you want to make a splash, have the greatest impact, it would be at Diablo Canyon.”

Pro-nuclear figures agreed. The planned closure “sent shock waves through America’s electric utility industry” and “presents a stark challenge to both the nuclear industry and policy-makers,” wrote Ray Rothrock and a co-author in a 2016 USA Today opinion piece.

Rothrock, a Bay Area venture capitalist with degrees in nuclear engineering, had already been working with other atomic power advocates to revive the industry. Though his initial Diablo Canyon complaints fell on deaf ears, he and his allies would be heard from again.

‘Unacceptable’ outages

In August 2020, a brutal heat wave hit California. Temperatures in Death Valley reached 130 degrees. The California Independent System Operator, or Cal ISO, which manages most of the state’s electricity grid, instituted two days of early-evening rolling blackouts. They affected over 800,000 customers for between eight minutes and two-and-a-half hours.

A follow-up state investigation partly blamed the outages on solar power output falling faster than demand as the sun set. The probe also cited grid-management problems.

Newsom, now a year into his first term as governor, called the outages “unacceptable and unbefitting of the nation’s largest and most innovative state.” (He would later tell the L.A. Times that those 2020 blackouts got him rethinking Diablo Canyon’s future.)

Building an electricity-supply system is a balancing act. Too few power sources can lead to frequent blackouts. Too many can leave customers paying for expensive, idle equipment. California utilities already charge some of the highest electric rates in the nation.

But California’s supply situation was changing fast. In June 2021, the CPUC authorized an additional 11,500 megawatts of power supply, about five times the output of Diablo Canyon.

A September 2021 study by the staff of the California Energy Commission, or CEC, said that modelling showed a “reliable system” at projected power levels through 2026. A February 2022 CPUC document said the planned power portfolio “meets stringent reliability standards.”

All the while, battery storage was improving. That same month, the Cal ISO said 2,359 megawatts of battery storage had been added to the grid in 2021. Such storage, charged during the hours when electricity supplies are abundant, is a vital supplement to solar and wind power.

This added capacity was 10 times the amount of battery storage available during the 2020 blackouts, though Cal ISO, in a written response, declined to speculate about whether the added storage could have averted the blackouts. (Currently, there are over 14,000 megawatts of installed battery capacity, according to Cal ISO.)

With more battery power online and the Diablo deal done, Hallie Templeton, the legal director at Friends of the Earth, a participant in the closure deal, considered the issue settled. The possibility of extending the plant’s operations past 2025 “was not even on my radar,” she said.

But others had it on their screens. In 2021, Rothrock, the pro-nuclear venture capitalist, got a call from Armond Cohen, a fellow nuclear advocate and the executive director of Clean Air Task Force, a Boston-based non-profit. He was seeking financing for a study proposed by MIT researchers, who wanted to evaluate keeping Diablo Canyon operating to desalinate vast amounts of water for an often-parched state.

Rothrock, in a recent interview, recalled Cohen saying the study could be the jumping-off point for a multimillion-dollar campaign to save the nuclear plant. Rothrock agreed to help fund the study. Though the research would be academically independent, Diablo Canyon supporters believed the plant would prove its worth.

Ultimately, the pro-Diablo Canyon effort raised about $2.5 million, Cohen said in an interview, much of it from the tech industry, with individual donations of up to about $100,000.

A longshot campaign

Early on, Cohen hired Dan Richard, a former senior vice president for public policy and governmental relations at PG&E. Richard, a 75-year-old business consultant, had started in California politics in 1978 as a young aide to Gov. Jerry Brown. He was at PG&E during the 2001 California electricity crisis, when rolling blackouts and soaring wholesale power prices hit the state and temporarily pushed PG&E into bankruptcy proceedings.

For the Diablo Canyon effort, Richard assembled a team of consultants, pollsters and lobbyists. He also reached out to influential people he thought might help.

One was Cal ISO president Elliot Mainzer. “At first he said, ‘Good luck’,” recalled Richard. “But the conversations kept getting longer and longer until we were meeting for breakfast and talking about how to keep Diablo open.”

Left: California Gov. Jerry Brown in 2012 with Dan Richard, then chairman of the California High-Speed Rail Authority. Richard would go on to advocate for Diablo Canyon.(AP Photo/Damian Dovarganes) Right: Richard lobbied California Independent System Operator President Elliot Mainzer, second from left, to keep Diablo Canyon running. (AP Photo/Alberto Mariani)

While Richard never asked Mainzer about possible conversations with Newsom, “I am sure he was engaged with the governor’s office,” he said.

In a written response to a question about Richard, Cal ISO said “Mr. Mainzer had conversations with advocates from all sides of the issue.”

Richard also contacted the International Brotherhood of Electrical Workers, Local 1245, which represents employees at Diablo Canyon and supported Newsom’s 2018 gubernatorial bid, calling him “as good a friend in the political world as 1245 has ever had.” Under the 2016 closure agreement, plant workers had reaped tens of millions of dollars in extra pay to keep them on the job until 2025.

Another pro-Diablo Canyon activist was Isabelle Boemeke, a Brazilian fashion model turned nuclear power proponent with the online persona “Isodope.” S

he shared a “Save Diablo Canyon” video on TikTok, wearing a futuristic outfit: “You’ve learned from my makeup tutorials that it’s not a look without mascara — and that when nuclear plants are shut down, they’re replaced by fossil fuels.”

Boemeke organized a rally for the plant. Her Save Clean Energy group sent a letter to Newsom signed by former energy secretary Steven Chu and 78 other scientists and academics calling the planned closure “irresponsible” and possibly “catastrophic.”

Boemeke, in an interview with the Chronicle, noted Diablo Canyon’s history as a potent symbol of nuclear power. “If you save the plant it will send such a powerful message that the tides are turning.” Richard said Boemeke was “a very positive factor” in the campaign.

Left: Ray Rothrock, venture capitalist and philanthropist, was one of the chief proponents of keeping Diablo Canyon running, helping to fund a study to prove its utility. (Lea Suzuki, S.F. Chronicle) Right: Isabelle Boemeke, a Brazilian model turned pro-nuclear social media influencer, at a photo shoot at Diablo Canyon on Aug. 5, 2025. (Courtesy Of The Isodope Team)

The study

The Diablo Canyon study, which was done jointly by faculty from MIT and Stanford, came out in November 2021. As its funders hoped, it said extended operation of the nuclear plant would provide cost-effective, greenhouse gas-free electricity and water desalination as well as produce hydrogen, a zero-carbon fuel. (The desalination and hydrogen ideas have yet to go anywhere.)

The study attracted attention, including a favorable Washington Post editorial. The pro-Diablo Canyon campaign also got an op-ed piece into the L.A. Times by former U.S. energy secretaries Chu and Ernest Moniz.

“We met with the governor’s office, legislators, unions, local tribes. We briefed everyone,” said Jacopo Buongiorno, an MIT professor and a study co-author. Officials in the governor’s office “listened with great interest.”

Then-Energy Secretary Jennifer Granholm also weighed in. In an interview with Reuters, she suggested California state officials could reconsider closing Diablo Canyon.

Public opinion was behind them — another sign of a cultural shift toward embracing nuclear power after years of skepticism. A poll of Californians commissioned by Richard found 58% favored keeping Diablo Canyon open with 32% opposed. Richard quietly slipped the results to the Newsom camp.

In April 2022, Richard received a call from Scott Wetch, the IBEW’s Sacramento lobbyist. Wetch said he had just talked with Ana Matosantos, Newsom’s cabinet secretary. She felt the state couldn’t do without Diablo Canyon.

“I was dancing a little jig at this point in the call,” Richard recalled. “It was the first indication we might win this thing.”

Wetch said Richard’s recounting of the conversation “sounds accurate.”

Matosantos said she didn’t recall such a conversation with Wetch.

Moving the margins

Several days later, Newsom went public. He gave an interview to the L.A. Times in which he first spoke about keeping Diablo Canyon open longer than planned. Newsom said he’d heard from scientists, activists and former U.S. energy secretaries advocating for the nuclear plant.

Next, officials from state energy agencies held a media briefing in response to inquiries from the press. They spoke of potential shortfalls of 1,700 megawatts or possibly more — a stark contrast with the rosier forecasts of a few months earlier.

Left: A sign board with workers' signatures is displayed at the Diablo Canyon Power Plant near Avila Beach, Calif., on Thursday, Dec. 4, 2025. Diablo Canyon is California's last nuclear power plant, In 2022, Governor Newsom granted a reprieve to its decommissioning, and now it could remain open well into the future. (Carlos Avila Gonzalez/S.F. Chronicle) Right: FILE - California Gov. Gavin Newsom discusses the effect of the drought on power generation after touring the Edward Hyatt Power Plant at the Oroville Dam, in Oroville, Calif., on April 19, 2022. Owner Pacific Gas & Electric decided six years ago to close the twin-domed Diablo Canyon Nuclear Power Plant by 2025. But Democratic Gov. Gavin Newsom, who was involved in the agreement to close the reactors, has prompted PG&E to consider seeking a longer lifespan for the plant. (AP Photo/Rich Pedroncelli, File)

Asked recently about the discrepancy, the CEC, in an email, said the newer projections “identified potential shortfalls due to factors not fully captured” in earlier analyses. Those factors included climate-change impacts and delays in getting new renewable resources online.

But the darker outlook also highlighted different ways state officials can define a “shortfall.”

In California, the goal is to have no more than one day every 10 years when a power shortage causes blackouts. To meet this 1-in-10 reliability standard, as it’s called, the electric system tries to have enough power to meet expected peak demand and still maintain a “reserve margin” — an extra cushion of supply — to handle unexpected events. In 2022, the California system aimed for a reserve margin of 15%, a common utility industry level.

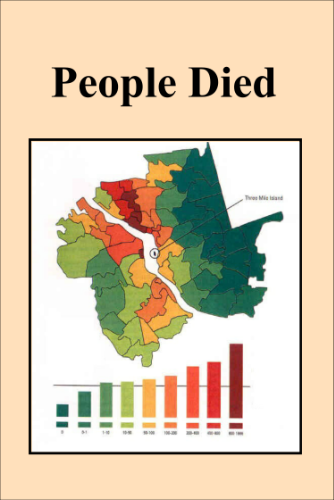

A May 2022 CEC staff report showed that, in 2026, the first year when Diablo Canyon would be fully closed, the projected reserve margin exceeded 15% every hour of summer peak-demand months. The reserve margin would even meet a higher target of 22.5% — except for several hours each day in September, when it would fall short by 1,700 megawatts.

These relatively few hours each year are at the heart of the reliability concerns and, to a degree, the debate over Diablo Canyon. An extreme heat event, such as the one that prompted the August 2020 blackouts, could require a 22.5% reserve margin, state energy officials say. Such events are expected to occur more frequently with climate change, but still aren’t estimated to occur frequently enough to be part of the official reliability planning standards.

Even such concerns for just a relatively few hours during high-demand months was apparently too much risk for Newsom.

Left: The Diablo Canyon Power Plant seen in 2015 through a car window. The plant has two Westinghouse-designed 4-loop pressurized-water nuclear reactors operated by Pacific Gas & Electric. (Nancy Pastor for the San Francisco Chronicle) Right: A PG&E power substation in 2020. The power giant owns and operates the Diablo Canyon plant, which can power hundreds of thousands of homes. (Paul Chinn/The Chronicle)

‘A very heavy thumb on the scale’

After expressing interest in extending Diablo Canyon’s life, Gov. Newsom helped the plant qualify for inclusion in a $6 billion U.S. Department of Energy fund to support nuclear power facilities. At the time, state officials said they were looking to this federal money to repay the $1.4 billion state advance for Diablo Canyon.

In the last hours of the 2022 legislative session, during another brutal heat wave, the governor pushed through SB 846, the Diablo Canyon extension bill. Though it passed with large majorities, doubts lingered.

It “remains unclear whether the scenarios shared by the Newsom administration accurately portray future realities,” said one legislative bill analysis, “or are unnecessarily conservative and costly.”

The law directed the CEC to determine whether Diablo Canyon was needed. In early 2023, the agency issued its answer: No and Yes.

Without the nuclear plant operating past 2025, California “will meet current resource adequacy planning standards from 2024 through 2030,” the report said.

But grid reliability risk remained from supply delays and “climate-driven events,” so it would be “prudent” to keep the nuclear plant operating, the report also said. To reach this conclusion, the CEC report pointed to the 22.5% reserve margin — as well as a 26% margin for an event like a September 2022 heat wave, which produced a record electricity demand, though no blackouts. It estimated that this kind of event could occur once every 14 years, more often than in the past, but still less frequently than the official 1-in-10 reliability target.

“It becomes very hard to avoid the conclusion that CEC staff put a very heavy thumb on the scale to produce a result desired by the Governor,” wrote Daniel Hirsch, then the president of the nuclear safety nonprofit Committee to Bridge the Gap, which opposed the plant, in a critique of the report.

In an email response to such criticism, the CEC said its work was “based solely on technical reliability analyses — not politics.”

Left: Diablo Canyon Nuclear Power Plant protests organized by Abalone Alliance in 1981. The plant has been at the center of many nuclear protests. (Mike Maloney/The Chronicle) Right: Carina Corral, Strategic initiatives manager at the Diablo Canyon Power Plant, stands near the Unit One turbines at the plant. The continued life of the plant is seen as a symbol of the endurance of nuclear power (Carlos Avila Gonzalez/S.F. Chronicle)

These mixed messages have continued. Last year, a CEC official told a legislative hearing that the state was at risk of electricity shortfalls without Diablo Canyon. However, a CEC report a few months later said that, even without the nuclear plant, “the current analysis continues to well exceed reliability targets through the 2020s.”

A CEC response to questions said the legislative testimony spoke to “potential resource shortfalls in extreme scenarios” while that later report “presented a broader view under typical conditions.”

“Yes, we can meet normal planning standards,” said CEC Vice Chair Siva Gunda in a recent interview. “But those standards do not account for the new climate-driven risks that we’re seeing.”

Falling short?

In the past, electricity systems largely relied on fossil fuel or nuclear plants that either ran all the time or could be powered up on short notice. Solar and wind power sources can be more variable depending on weather conditions —- which is why battery storage is important.

“What Diablo does is give you stability of power. That is useful,” said Gunda.

Critics counter that it is also a blunt instrument. Using the inflexible output of a giant nuclear plant to assuage a relatively few hours of worry each year is not only expensive and inessential but tends to crowd out renewable energy sources during periods of lower demand. Further steps to reduce demand, such as giving consumers incentives to shift electricity uses away from those worrisome hours, is a better approach, they contend.

Meanwhile, the state continues to add resources to the grid: over 25,000 megawatts since Newsom took office in 2019, according to the CEC. The CPUC has set the reserve margin for next year at 18%, with the aim of 22.5% during summer months. An August state report showed the grid with a 23.5% reserve margin — without Diablo Canyon. With the nuclear plant, the margin was a little over 28%.

In a written response to questions, the CEC said there are currently enough resources without Diablo Canyon to handle some extreme weather events but not enough to handle others.

Birds fly by the harbor at the Diablo Canyon Power Plant near Avila Beach, Calif., on Thursday, Dec. 4, 2025. The plant will stay open until at least 2030, and some suspect it could operate for longer.

Carlos Avila Gonzalez/S.F. Chronicle

As for that nearly $1.4 billion state advance to PG&E, which officials hoped would be repaid by the Energy Department subsidy program, the picture has darkened.

An August state report said it won’t be known until at least 2027 how much money will come from the federal government. But the current reimbursement forecast was just $741 million, the report said — which could leave the state hundreds of millions of dollars short.

In a statement, state Sen. John Laird, whose district includes Diablo Canyon, said he’d supported extending the plant’s operating life partly on the condition “that federal support would offset the state’s financial commitment.”

“If that support now falls short, it is deeply concerning” he went on. “We must ensure that Californians aren’t burdened with the consequences.”

PG&E’s cost-benefit analysis to customers of Diablo Canyon, by one measure, has also shifted.

Touting the financial benefits of Diablo Canyon operating to 2030, PG&E said in a March public statement that without the plant, ratepayers’ bills would be $3.2 billion higher. PG&E arrived at the calculation using a CPUC-determined cost number for obtaining alternate power sources to ensure reliability.

However, CPUC recently revised that cost number downward by over 70% — turning $3.2 billion potential net savings into more than $500 million in net costs.

A PG&E spokesperson said the company didn’t have a comment on the changed number beyond reiterating its belief in “the critical role” Diablo Canyon “plays in the state’s clean energy future.”

Beyond 2030

Deep inside Diablo Canyon, the walls begin to shake. Control panels flash and emergency sirens blare out danger.

This is not the plant’s real control room. It is the simulator, or “the sim” — a training center for PG&E workers that was recently visited by the Chronicle.

To PG&E, the sim is part of a comprehensive effort that ensures Diablo Canyon can safely handle any threats from nearby earthquake faults — a position that plant critics continue to dispute. Another, more recent point of contention: critics’ concerns that a crucial part of the unit 1 reactor might be dangerously weakened from decades of radiation exposure.

Simulator specialist Brian Sawyer checks a panel at Diablo Canyon, used to train operators on potential problems at the Diablo Canyon Power Plant.

Carlos Avila Gonzalez/S.F. Chronicle

Some observers believe an effort is coming to extend Diablo Canyon’s life past 2030. PG&E has requested new federal licenses that would allow the plant to operate until 2045. “Looking beyond 2030, (Diablo Canyon’s) output could help address the growing electricity demand across the state,” said a company statement to the Chronicle. Proponents often cite the growing demands from AI data centers.

PG&E also sent a CPUC document, dated Sept. 30, with charts showing that if Diablo Canyon ran to 2045 it could save ratepayers billions of dollars by lessening the need to build new power sources.

In a written reply to questions, a CPUC spokesperson said its extended recent look at Diablo Canyon was “informational-only” and wasn’t “a policy recommendation or preferred outcome.”

“From what I have seen, PG&E would really like to extend Diablo Canyon past 2030,” said Laird in a recent interview. However, “the jury is still out on a number of issues that need to be analyzed before addressing such a consideration.”

PG&E resolved one potential issue last week The state Coastal Commission had previously held up its approval for the plant’s plans over a dispute about what steps PG&E needed to take to compensate for damage to local marine life from the plant’s use of seawater. But on Thursday, it gave its approval for Diablo Canyon to continue operating until at least 2030.

Asked about the prospect of the plant staying open a good deal longer, the Newsom spokesman said, “we remain focused on keeping the option of extension until 2030.”