Molly Taft, Apr 29, 2025, 10:59 AM

States and Startups Are Suing the US Nuclear Regulatory Commission

Critics of the NRC say its red tape and lengthy authorization timelines stifle innovation, but handing some of its responsibilities to states could undermine public trust and the industry’s safety record.

Photograph: Andrew Harrer/Getty Images

American nuclear is in 25-year-old Isaiah Taylor’s blood: his great-grandfather worked on the Manhattan Project. In 2023, Taylor, who dropped out of high school to work in tech, started his own nuclear company, Valar Atomics. It’s currently developing a small test reactor, named after Taylor’s great-grandfather. But the company says that overly onerous regulations imposed by the US Nuclear Regulatory Commission (NRC), the country’s main regulatory body for nuclear reactors, has forced Valar Atomics to develop its test reactor overseas.

In early April, Valar Atomics, in addition to another nuclear startup, Deep Fission, as well as the states of Florida, Louisiana, and Arizona’s state legislature, signed onto a lawsuit against the NRC. The lawsuit, originally filed in December by Texas, Utah, and nuclear company Last Energy, blames the NRC for “so restrictively regulat[ing] new nuclear reactor construction that it rarely happens at all.”

Science Newsletter

Your weekly roundup of the best stories on health care, the climate crisis, new scientific discoveries, and more. Delivered on Wednesdays.

By signing up, you agree to our user agreement (including class action waiver and arbitration provisions), and acknowledge our privacy policy.

The US has historically been the global powerhouse of nuclear energy, yet only three reactors have come online over the past 25 years, all behind schedule and with ballooning budgets. Meanwhile, other countries, like China and South Korea, have raced ahead with construction of reactors of all sizes. Some nuclear advocates say that the US’s regulation system, which imposes cumbersome requirements and ultra-long timelines on projects, is largely to blame for this delay—especially when it comes to developing new designs for smaller reactors—and that some reactors should be taken from the NRC’s purview altogether. But others have concerns about potential attempts to bypass the country’s nuclear regulations for specific designs.

The NRC has long been criticized for its ultra-slow permitting times, inefficient processes, and contentious back-and-forth with nuclear companies. “The regulatory relationship in the US has been described as legalistic and adversarial for nuclear,” says Nick Touran, a licensed nuclear engineer who runs the website What Is Nuclear. “That is kind of uniquely American. In other countries, like France and China, the regulators are more cooperative.”

The lawsuit takes these criticisms one step further, claiming that by regulating smaller reactors, the NRC is misreading a crucial piece of nuclear legislation. In 1954, Congress passed the Atomic Energy Act, which created modern nuclear regulation in the US. That law mandated regulations for nuclear facilities that used nuclear material “in such quantity as to be of significance to the common defense and security” or that use it “in such manner as to affect the health and safety of the public.”

“We would love the NRC to respect the law that was written,” says Taylor, who believes the reactor his company is working on sits outside of that mandate. “What it would do for us is to allow innovation to happen again. Innovation is what drives the American economy.”

“The NRC will address the litigation, as necessary, in its court filings,” agency spokesperson Scott Burnell told WIRED in an email.

While we generally think of nuclear reactors as huge power plants, reactors can be made much smaller: Models known as small modular reactors, or SMRs, usually produce a third of the energy of a larger reactor, while even smaller reactorsknown as microreactors are designed small enough to be hauled by semitruck. Because of their size, these reactors are inherently less dangerous than their large counterparts. There’s simply not enough power in an SMR for a Three Mile Island–style meltdown.

The lawsuit argues that by mandating a cumbersome licensing process for all types of reactors—including those that are safer because of their size—the NRC is both violating the Atomic Energy Act and stifling progress. A company called NuScale, the only SMR company to get NRC approval for its model, spent $500 million and 2 million hours of labor over several years just to get its design approved. In late 2023 it pulled the plug on a planned power plant in Idaho after customers balked at the projected high price tag for power, which soared from an estimated $58 per megawatt-hour in 2021 to $89 per megawatt-hour in 2023.

The lawsuit comes at a unique time for nuclear power. Public sentiment around nuclear energy is the highest it’s been in 15 years. Dozens of new nuclear startups have cropped up in recent years, each promising to revolutionize the American nuclear industry—and serve power-hungry industries like data centers and oil and gas. Private equity and venture capital invested more than $783 million in nuclear startups in 2024, doing twice the number of deals in the sector as they did in 2023.

The lawsuit “is about getting steel in the ground. This is about getting nuclear on the grid,” says Chris Koopman, the CEO of the Abundance Institute, a nonprofit focused on encouraging the development and deployment of new technology. The Institute, which was founded last year, has no standing in the lawsuit and does not represent any plaintiffs but has served as a “thought partner,” per Koopman, who coauthored an op-ed in The Wall Street Journal in January announcing the lawsuit.

Deep Fission, one of the plaintiffs in the lawsuit, seeks to generate electricity using small modular reactors placed a mile underground—a model its CEO, Liz Muller, says is both safer and cheaper than traditional construction. Even though Deep Fission is a party in the lawsuit, the company has also begun pre-licensing its design with the NRC. Muller sees the lawsuit as bringing a new approach to the agency regarding SMRs: helping it to develop “a regulatory sandbox, where we’re allowed to explore approaches to regulations while we’re moving forward at the same time.”

The lawsuit posits that individual states “are more than capable of regulating” smaller reactors. Thirty-nine states are already licensed by the NRC to handle and inspect nuclear material, while Koopman points out that the states involved in the lawsuit have recently passed legislation to speed the construction of nuclear projects in-state. “All of the states involved in the case have already entered into agreement with the NRC, in which the NRC has recognized that they know their stuff,” he says.

Taylor believes allowing states to compete on regulation would help boost safety within the field of small modular reactors. “Innovation is what drives the safety ball down the field, and the only way to do that is to have different regulators with different ideas,” he says. “That’s federalism 101.”

Adam Stein, the director of the Nuclear Energy Innovation program at the Breakthrough Institute, an eco-modernist policy center, sees some serious flaws with this approach. He says that while some states, like Texas, may have the resources and the knowledge to create their own effective regulatory body, other states may struggle. Stein likens a patchwork of different regulations as being akin to car seat laws, where the age of the child required to be in a car seat varies across states, making it tough for a parent to plan a road trip.

“Some states are less consistent in applying safety standards than others,” he says. “Some states would prefer their standards to be stricter than national standards. Some states have reduced safety standards from nationally recommended standards.”

Muller says she understands these concerns. “There is a risk if we get wildly different regulatory processes, that would not be a great result,” she says. “But I think there’s also an opportunity for states to move forward and then for other states to piggyback on what has been developed by the earlier adopter.”

Stein also foresees a possibility for continued red tape, as even with state-level regulation, the NRC would still be forced to review individual reactor designs to see if they were safe enough to pass off for state review. “A developer couldn’t just assert that their design is so safe, that it’s below the line,” he says. “It’s still going to have to go through a review to

determine whether the NRC should review it.”

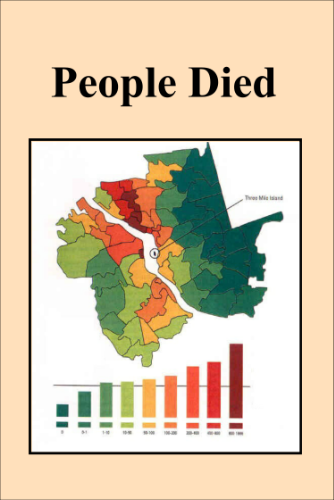

Just because a nuclear reactor can’t cause massive damage to big populations doesn’t necessarily mean it’s fail-safe. The only deadly nuclear accident on US soil occurred at a tiny reactor in Idaho, which killed its three operators in the early 1960s. Designs for small reactors have made leaps and bounds in safety since then—a development Touran says is thanks in part to regulations from the federal government.

“I believe a well-designed small reactor, subject to reasonable nuclear design standards based on years of lessons learned, would be very safe,” says Touran. “I do not believe that this means anyone should be able to go out and build a small reactor with minimal oversight.”

There have been efforts in recent years to speed up the NRC’s permitting process. In 2019, during his first term, President Donald Trump signed the Nuclear Energy Innovation and Modernization Act; among its many reforms, it mandated that the NRC shift around key licensing processes and create a new process for licensing smaller, more technologically varied reactors. Last year, President Joe Biden signed the ADVANCE Act, which made even more changes to the NRC process; both of these pieces of legislation passed with overwhelming bipartisan support.

“At this point, the NRC says pretty willingly that they’re working hard to be more efficient, that they understand they need to be more efficient, that they have been more efficient with recent licensing applications,” says Klein.

For developers like Taylor, this progress is too little, too late. “Do we really want China and Russia to be the global nuclear developers for the world?” he says. “I don’t. I would like the United States to be the nuclear developer of the world.”

Permitting reform alone, especially in the SMR space, may not solve the issue of competing with other world powers. Nuclear energy might be overregulated, but it is also expensive to build, even for smaller reactors, requiring big up-front investments and a large amount of labor. NuScale did lose valuable time and money on a cumbersome regulatory process—but its energy was also competing in price against gas and renewables, which are, on average, cheaper than nuclear power from plants that have been running for decades.

After decades of battling public fear of nuclear plants, nuclear acceptance has reached a pivotal moment. When compared to the massive health toll from fossil fuels, which research shows are responsible for 1 in 5 deaths around the world, nuclear power is exorbitantly safe. But there’s a sense from some advocates that some of the hard-won trust nuclear energy now has from the public—supported by decades of careful regulation—is in danger if the movement becomes too cavalier about safety.

When Valar announced it would join the lawsuit, Taylor published a blog post on the company’s website that claimed that the company’s reactor was so safe that someone could hold the spent fuel in their hands for five minutes and get as much radiation exposure as a CAT scan. Touran questioned this claim, leading Taylor to post the numbers behind the company’s analysis on X. Another nuclear engineer ran his own calculation using these inputs, finding that holding fuel under the conditions provided by Valar would give a “lethal dose” of radiation in 85 milliseconds. (Taylor told WIRED that Valar is working on a “thorough analysis” in response that will be public in a few weeks and that the initial claims around the spent fuel were simply “a thought experiment we did for our own internal illustration purposes” and not part of the lawsuit materials.)

“We’ve operated reactors so well for so long that a whole new breed of advocates and even founders mistakenly believe that they’re fail-safe by default,” says Touran. “The reality is they’re made fail-safe by very careful and well-regulated engineering and quality assurance.”