Trump’s “wins” on nuclear power are losses for taxpayers and public safety

By Edwin Lyman | May 19, 2025

The Three Mile Island Unit 1 (right) in Pennsylvania is one of the first two shutdown US reactors, with Palisades Nuclear Power Plant in Michigan, to be on path of being restarted to generate electricity again. The dormant cooling towers (left) are from Unit 2, which was permanently damaged in the 1979 accident. (Credit: Constellation Energy, CC BY-SA 4.0 , via Wikimedia Commons)

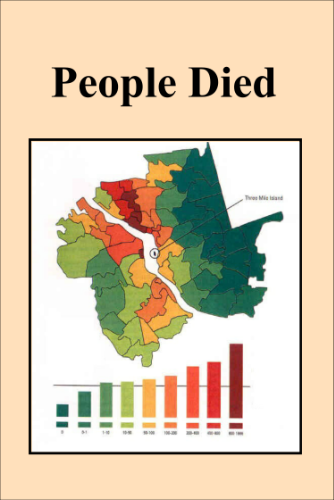

The US nuclear power industry is justifiably apprehensive about its future under the second Trump administration. President Donald Trump’s predilection for taking a sledgehammer to both the federal budget and the administrative state would appear to be the exact opposite of what the industry crucially needs to move forward: a predictable, long-term expansion of the billions of dollars in public funding and tax benefits it received under Joe Biden, arguably the most pro-nuclear power president in decades.

With little attention to safety and security concerns, President Biden and Congress made available an array of grants, loans, and tax credits to both operating and proposed nuclear plants, hoping to make them more appealing to risk-averse private investors. Now, at least some of these programs, which stimulated the emergence of a vast bubble of nuclear startups funded by token amounts of venture capital, may be on the chopping block. But this would not be bad news for the industry in the long run. The Biden administration’s “all of the above” support for nuclear power was on shaky ground even before Trump took office, and it needed a critical evaluation and reset.

However, if made final, the draft White House executive orders meant to bolster nuclear power growth that were leaked earlier this month would be a huge lurch in the wrong direction. By focusing on the wrong issues—namely, by scapegoating the Nuclear Regulatory Commission (NRC)’s oversight over the industry’s own inability to raise sufficient capital and competently manage large, complex projects—the orders would undermine the regulatory stability that investors demand, not to mention create the potential for significant safety and reliability problems down the road.

Trump’s mixed messages. Many in the industry expected President Trump to be an even bigger booster of nuclear power than his predecessor. They must now be confused by the mixed signals coming out of the new administration.

On the first day of his second term, Trump ordered an immediate pause and review of all appropriations provided through the 2022 Inflation Reduction Act and the 2021 Infrastructure Investment and Jobs Act. The decision initially swept up grants and loans for nuclear power along with other low-carbon energy projects, including a $1.52 billion loan guarantee that the Biden administration had awarded to Holtec International to restart the Palisades nuclear plant in Michigan, as well as billions in grants for the two so-called “advanced demonstration power reactor projects” proposed for construction: the TerraPower Natrium sodium-cooled fast reactor in Kemmerer, Wyoming and the X-Energy Xe-100 high temperature gas-cooled reactor complex in Seadrift, Texas.

Despite giving lip service to the need to “unleash” nuclear power, the actions of Energy Secretary Chris Wright, a former fossil fuel industry executive, have not matched the rhetoric. As part of the Trump administration’s self-congratulatory celebration of its first 100 days, the Energy Department posted a list of “11 big wins for nuclear.” However, these were typically continuations of programs from previous administrations rather than radically new initiatives.

The first claimed “big win” was restarting the Palisades nuclear plant. It referred to a March announcement that the Energy Department’s Loan Projects Office was going to release additional installments of the Palisades loan guarantee. But this had already been approved under the Biden administration. Even so, the future of the nuclear-friendly office, which in the past had awarded $12 billion in loan guarantees to prop up the two new (and wildly over-budget) reactors at the Vogtle plant in Georgia, remains in doubt under the new administration’s effort to shrink federal agencies. After reports of major staff cuts at the Loan Projects Office—or maybe rather “at the loan office”—surfaced in April, panicked nuclear advocates wrote to Secretary Wright in protest, and there are indications that the department may be moving to shrink the office even though some level of support for nuclear projects could remain.

The second so-called “win” on the Energy Department’s list—“unleashing American-made SMRs” (small modular reactors)—was simply a reissuance of a 2024 solicitation making available $900 million in repurposed funding provided by the Infrastructure Investment and Jobs Act. The funding redirection seeks to support the development of light-water SMRs, minus the Biden administration’s requirements for advancing societal goals, such as community engagement, that could help facilitate siting unpopular facilities. But this amount of funding is inconsequential considering the billions of dollars that likely would be needed to build even a single SMR facility. The first light-water SMR to receive a design certification from the Nuclear Regulatory Commission (NRC), NuScale, was estimated to cost $9.3 billion for a plant with six modules of 77 megawatts of electric power each.

The third nuclear so-called “win” was the submission in March by X-Energy and Dow of a construction permit application to the NRC to build the Long Mott plant (four Xe-100 reactors) in Seadrift, Texas. This can only be considered a win for the Trump administration if one forgets that the application was filed at least a year later than originally anticipated.

The fourth so-called “win”—high-assay low-enriched uranium (HALEU) for advanced reactor developers—would be better characterized as an admission of failure. HALEU is the fuel that most non-light-water reactors under development with Energy Department funding would use, which means it must be available if these reactors are ever going to operate. But because the United States has failed to date to enable industrial-scale enrichment of HALEU to support the new reactor projects, the Energy Department must instead draw from stockpiles of “unobligated” enriched uranium that is not constrained by peaceful-use agreements. These stockpiles were originally preserved for other uses, such as fueling operating reactors that produce tritium for the nuclear weapon stockpile. The decision to tap into this reserve is essentially a loan to the commercial sector, but it will likely have to be repaid in the future.

The remaining seven “big wins” are primarily incremental technical milestones in ongoing research programs: interesting, perhaps, but hardly major achievements.

What is missing from the Trump administration’s “nuclear wins” list, unfortunately, is any mention of a National Academies of Sciences, Engineering, and Medicine (NASEM) study that was announced in the final days of the Biden administration by former National Nuclear Security Administrator Jill Hruby to assess the proliferation risks of HALEU. Hruby ordered the study in response to an article in Science magazine last year in which my colleagues and I raised concerns about the potential usability of HALEU for nuclear weapons. The study was suspended by the Trump administration, and its future remains uncertain.

The cost of “winning.” With the Trump administration determined to cut trillions of dollars from the federal budget, the mere survival of any program might be considered a “win” by the program’s supporters. But simply staying the course is not going to be nearly enough to see the nuclear projects already underway to completion, much less pay for all the new reactors that nuclear advocates hope will spring up to meet the huge increases in demand, such as from the deployment of data centers.

Since 2020, the costs of the Xe-100 Seadrift and Natrium projects have ballooned due to inflation and supply chain problems. In 2023, X-Energy revised the cost of its four-reactor Long Mott plant upward to $4.75 to $5.25 billion, and in 2024, Bill Gates, the founder of TerraPower, estimated the cost of the Natrium project as “close to ten billion” dollars. Yet, these estimates were made before factoring in the potential impacts of the Trump tariffs on commodity prices and the supply chain. In total, the cost of these two projects has more than doubled, even as the original authorized amount of $3.2 billion of government support has not changed.

If the pipeline for providing previously appropriated funding continues and Congress does not provide billions of additional dollars for these projects, the remaining cost burden will fall on the companies themselves. It is not at all clear if TerraPower is going to be willing to pony up.

Similarly, the tax credits provided by the Inflation Reduction Act for new nuclear plants (if they survive) are not likely to be enough to make them commercially viable. Even factoring in the tax credits, NuScale’s “Carbon Free Power Project” was still too expensive, and the project was cancelled in 2023.

To really “unleash” nuclear power, far greater subsidies would be required.

But this is not looking too likely in the current frenetic cost-cutting environment. In its proposed budget for the next fiscal year, the White House plans to cut funding for the Office of Nuclear Energy by $408 million (over a quarter of its current annual budget), which it says corresponds to “non-essential research on nuclear energy.” The future of other incentives, such as the tax credits under the Inflation Reduction Act, also remains uncertain, causing consternation within the nuclear industry.

Looking at the “nuclear loss” side of the ledger is the Trump administration’s assault on independent federal agencies, including the NRC. Only last year, there was bipartisan concern as to whether the NRC would have enough experienced personnel to efficiently handle a projected onslaught of new applications. Now, the succession of attacks on the NRC’s workforce—from DOGE’s fork-in-the-road e-mail offering voluntary departure to federal workers, to the end of remote work, to the termination of its collective bargaining agreement—will have predictably devastating effects on employee morale, retention, and recruitment. Moreover, Trump’s burdensome and confusing executive orders—including requirements that agency actions be reviewed in secret by White House political appointees, and all energy permitting regulations be periodically reissued or scrapped—are recipes for delays and chaos.

Being serious about supporting safe and economical nuclear energy. What would a genuine “win” look like for the US nuclear energy industry and the public, then?

A good start would be a comprehensive and objective reassessment of the technical viability and realistic costs versus benefits of the Energy Department’s ambitious nuclear power and fuel cycle programs. The focus of these programs must be on their safety, security, proliferation, and waste management implications. While the leaked draft executive orders display a predictable hostility to science-based analysis and environmental protection, President Trump—as a self-proclaimed savvy businessman—may appreciate when taxpayers are getting a bad deal. After all, during his first administration, he terminated the $100 billion “mixed-oxide” (or MOX) Fuel Fabrication Facility project in South Carolina. Trump terminated the MOX fuel program despite the entreaties of some of his most loyal supporters, such as Sen. Lindsey Graham, a Republican from South Carolina. Trump would be right to question, for example, whether a company founded by Bill Gates—one of the richest people in America—needs to continue receiving countless billions of dollars of federal subsidies.

A nuclear power program based less on hype and more on fiscal realities and genuine safety improvements could ultimately be a win not just for the corporate recipients of government largesse, but for the public at large.

Mike Argento

Mike Argento