VIEW 4 IMAGES

A new report has assessed the feasibility of deploying small modular nuclear reactors to meet increasing energy demands around the world. The findings don't look so good for this particular form of energy production.

Small modular nuclear reactors (SMR) are generally defined as nuclear plants that have capacity that tops out at about 300 megawatts, enough to run about 30,000 US homes. According to the Institute for Energy Economics and Financial Analysis (IEEFA), which prepared the report, there are about 80 SMR concepts currently in various stages of development around the world.

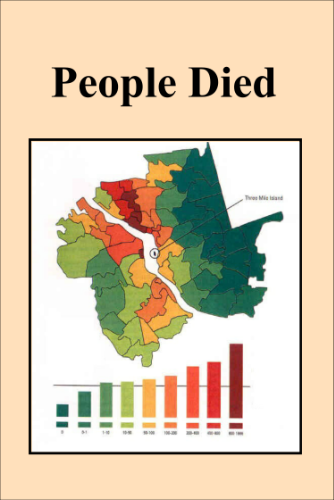

While such reactors were once thought to be a solution to the complexity, security risks, and costs of large-scale reactors, the report asks if continuing to pursue these smaller nuclear power plants is a worthwhile endeavor in terms of meeting the demand for more and more energy around the globe. The answer to this question is pretty much found in the report's title: "Small Modular Reactors: Still Too Expensive, Too Slow, and Too Risky." If that's not clear enough though, the report's executive summary certainly gets to the heart of their findings. "The rhetoric from small modular reactor (SMR) advocates is loud and persistent: This time will be different because the cost overruns and schedule delays that have plagued large reactor construction projects will not be repeated with the new designs," says the report. "But the few SMRs that have been built (or have been started) paint a different picture – one that looks startlingly similar to the past. Significant construction delays are still the norm and costs have continued to climb." The cost of SMRs is at the forefront of the report's argument against the deployment of the reactors. According to some of the data it provides, all three SMRs currently operating (plus one now being completed in Argentina) went way over budget, as this graph shows. The report authors also point out that a project in Idaho called NuScale had to be scrapped because during its development between 2015 and 2023, costs soared from $9,964 per kilowatt to $21,561 per kilowatt. Additionally, the costs for three other small plants in the US have all skyrocketed dramatically from their initial cost assessments. Not only are the excessive costs of building SMRs problematic in and of themselves, says the IEEFA, but the money being poured into the projects is money that is not being spent on developing other sources of energy that are cleaner, quicker to deploy, and safer. "It is vital that this debate consider the opportunity costs associated with the SMR push," write the authors. "The dollars invested in SMRs will not be available for use in building out a wind, solar and battery storage resource base. These carbon-free and lower-cost technologies are available today and can push the transition from fossil fuels forward significantly in the coming 10 years – years when SMRs will still be looking for licensing approval and construction funding." Such a debate has been considered by the reactor developers, argues X-Energy, which suggests that there is a basic flaw in IEEFA's study. "The information cited by IEEFA is inclusive of all program costs (including all engineering, development, and initial licensing efforts)," the company's Robert McEntyre tells New Atlas. "This effectively assigns nearly all costs of the company to one project, which is not representative because each subsequent project will benefit from all of the initial work to bring our technology to market. "Using IEEFA’s methodology, you could assign all of the engineering and development costs of the iPhone to the first iPhone (probably in the $ billions itself) and then claim it’s not a feasible product because it’s wildly expensive. This is a stark departure from the standard practice of accounting up front costs required to bring a product to market." That last comment from the IEEFA report authors also gets to another of the report's findings: that building SMRs simply takes too much time. The Shidao Bay project in China, for example, was supposed to take four years to build, but actually took 12; the Russian Ship Borne project had an estimated completion time of three years, but took 13; and the ongoing CAREM project in Argentina was supposed to be done in four years, but it's now in its 13th year of development. The report also points out that the MPower PWR project, which was one of the first planned SMRs in the US, had its plug pulled in 2017 after it was clear it wouldn't meet its 2022 deployment date – a decision that effectively wasted the $500 million that had already been spent on the effort. "Despite this real-world experience, Westinghouse, X-Energy and NuScale, among others, continue to claim they will be able to construct their SMRs in 36 to 48 months, perhaps quickly enough to have them online by 2030," write the authors. "GE-Hitachi even claims it ultimately will be able to construct its 300MW facility in as little as 24 months. "Admittedly, there is a not-zero chance this is possible, but it flies in the face of nuclear industry experience, both in terms of past SMR development and construction efforts and the larger universe of full-size reactors, all of which have taken significantly longer than projected to begin commercial operation." Despite breakthroughs in SMR manufacturing, such as the welding advance that allows workers to put together an SMR reactor vessel in 24 hours instead of 12 months, the time it takes to get these facilities into the field will likely continue to be a major barrier to their adoption. Both the unpredictable costs and the extraordinary building delays makes SMR development just too big of a risk, says the IEEFA. But that's not the only potential peril. Because the technology for this small-scale nuclear facility is fairly new and untested, risks could exist in terms of functionality and safety as well. For example, the authors question if the new SMRs will actually be able to output the kind of power they claim. Based on cost and development estimates going so widely afield, the sense in the report is that power output claims could also be off. In terms of safety, the report quotes a 2023 study for the US Air Force that said: "Since SMR technology is still developing and is not deployed in the US, information is scarce concerning the various costs for [operations & maintenance], decommissioning and end-of-life dissolution, property restoration and site clean-up and waste management." The authors also point out that because many SMRs are being built using identical technologies, if a component of that tech fails, it could easily affect reactors around the world. For example, they bring up the fact that steam generators have needed to be replaced at more than 110 pressurized water reactors (PWRs), with half of those operating in the US, because of the denting and wall thinning of tubes made from a material called "heat-treated Alloy 600." "We’re not arguing that new SMRs will have these same issues," they write. "We expect that the design and material decisions made for SMRs will reflect remedial measures taken at existing reactors. Our concern is broader in that a problem at one SMR might have serious repercussions at many other SMRs with the same standardized design." So: too expensive, too slow, and too risky. And not at all where we should be focussing our, um – energy – these days, as the study authors make clear in their conclusion. "At least 375,000 MW of new renewable energy generating capacity is likely to be added to the US grid in the next seven years," they say. "By contrast, IEEFA believes it is highly unlikely any SMRs will be brought online in that same time frame. The comparison couldn’t be clearer. Regulators, utilities, investors and government officials should acknowledge this and embrace the available reality: Renewables are the near-term solution." You can read the full report in PDF format online. Source: IEEFAToo Expensive

Too Slow

Too Risky

Conclusion